Dear Dave,

My husband and I just heard of your plan. We are excited to learn more about money, and we have already saved up $1,000 for our beginner emergency fund. Right now, we have a problem. My father has never taken his finances seriously, and the other day he asked us for $400 to pay his cell phone bill and overdraft fees at his bank. Even as an adult, he would go to his parents regularly before they died asking for money when he always had a good job. Giving him the money right now would make things really tight for our family, and we don’t want to lose the ground we have gained where our finances are concerned. Do you have any advice?

Brooke

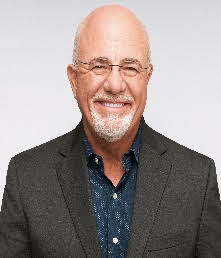

Dear Brooke,

Way to go! It makes me to happy to hear folks so charged up and on fire to get control of their finances. You won’t regret the decision.

I’m going to be straightforward with you, ok? You and you husband need do the right thing, no matter how dad reacts to this. And the right thing, right now, is taking care of your family first and not putting your finances in jeopardy. If I were in your situation, my answer to dad would be no.

I understand there’s a feeling of obligation to help your father. But it sounds like dad needs to learn a lesson or two about life and money. When you say your dad is irresponsible with money, handing him more of it won’t help. It would be like giving a drunk a drink. On top of that, it will reinforce the idea he can continue being dumb with money and there will be no consequences.

Trust me, I understand the emotions involved in helping out a parent. If you feel this is a situation where there is literally no alternative, I’d suggest making the $400 contingent on your dad beginning—and successfully completing—a good financial counseling course. Whatever you do, be gentle and respectful when you talk to him. And make sure he understands it hurts when you see him struggling.

But let him know, too, it’s his responsibility to work through his bills and take care of his finances.