Dear Dave,

I’m single, and I make $35,000 a year. Next year, my salary and bonuses should be around $50,000. I have a little over $30,000 in debt right now, including student loans, and I’m not sure how I’ll be able to keep up with bills and everything else right now if I have to save $1,000 for a starter emergency fund like you recommend. Can I get by with a starter emergency fund of $500?

Jonas

Dear Jonas,

I really think you’re making this whole thing sound a lot harder than it really is. They key is making and living on a budget, and that’s not rocket science. It’s a simple, written planning process where you give a name and a job to every dollar you make before the month begins.

Food, shelter, clothing, transportation and utilities are necessities, so they come first. After that, make sure you’re current on your debts. Once all that is out of the way, put every spare dollar you can into your emergency fund. If you do this with a sense of urgency, and limit spending to necessities, you’ll be surprised by how fast it will happen. And you’ll love the newfound sense of security.

The truth is you really need a starter emergency fund of $1,000 if you’re at a point in life where student loans and other debts are in the picture. That may seem like an impossible goal right now, but it should be your first priority. And a written, monthly budget will go a long way toward helping you achieve that goal.

You can do this, Jonas!

— Dave

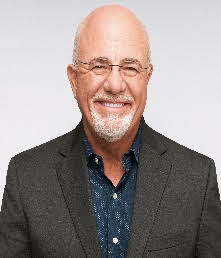

* Dave Ramseyis an eight-time national best-selling author, personal finance expert, and host of The Ramsey Show, heard by more than 18 million listeners each week. Hehas appeared on Good Morning America, CBS This Morning, Today Show, Fox News, CNN, Fox Business, and many more. Since 1992, Dave has helped people regain control of their money, build wealth and enhance their lives. He also serves as CEO for Ramsey Solutions.